Omnichannel Marketing: How Can Your Organisation Benefit?

Very few things change more quickly in business than digital technology and the associated terminology. A great example of this is omnichannel marketing. Simply stated, it’s a way of engaging customers using multiple touchpoints – such as text, chat, voice, video, email, and social media – to create a seamless user experience that builds customer loyalty.

In this blog, we’ll explore the demand for omnichannel engagement, as well as how organisations can use it to boost revenue, increase ROI, and meet growing consumer demand.

The Channel Evolution

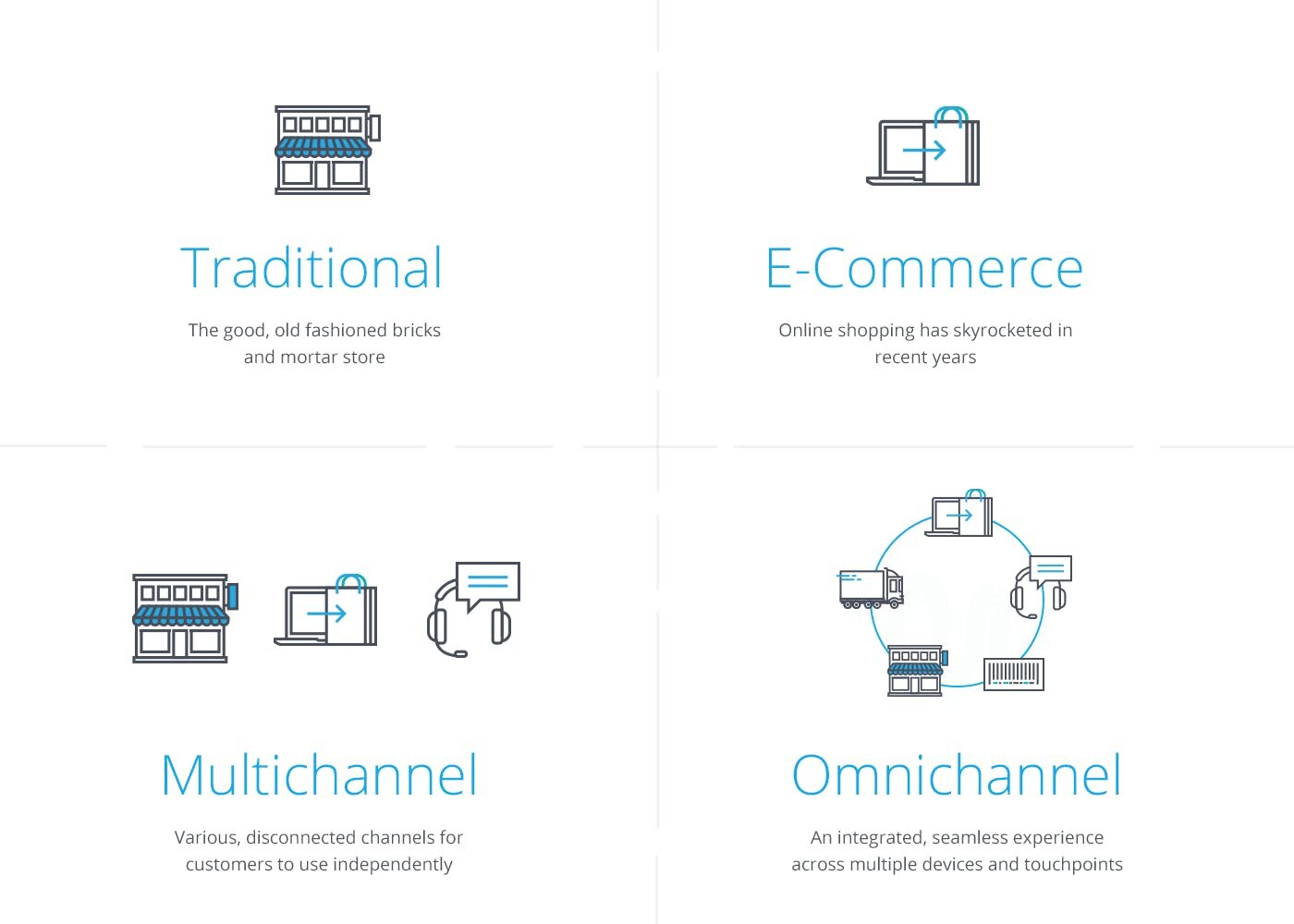

Consider the definition of “omni,” meaning “all” or “in all places.” Not long ago, offering customers a modest choice of digital channels might be considered a luxury. However, as technology rapidly accelerates, the need to target customers through a wider variety of integrated touchpoints has become essential to ensure the personalised and effortless experience they’ve come to expect.

Building an effective omnichannel marketing strategy requires the elimination of information silos and the development of digital collaboration across departments. This illustration shows the evolution of the anticipated user experience.

Starting at the Top

According to research by Worldpay, omnichannel shoppers spend somewhere between 50-300% more than traditional shoppers. With those numbers in mind, well-informed CEOs will act on that information in the coming years. This inevitably requires strategies that employ the latest technologies to understand and leverage consumer information collected during multichannel interactions.

Like any strategic approach, omnichannel engagement requires commitment from an organisation’s key executives, including the CEO, CMO, and CIO. While each role brings its own priorities to bear, ultimately they share the organisation’s common goals.

The CEOs perspective is broadest: the implementation of every strategy must consider the needs of internal and external stakeholders. From a slightly narrower perspective, the CMO must focus on growing business through insight into customer behaviours, regardless of the channels they select.

To that end, integrating customer information is essential to personalising the user experience, simplifying marketing workflows, and nurturing long-term customer loyalty. At the same time, the CIO must facilitate seamless back-office systems, secure sensitive customer information, comply with regulatory requirements, and share information efficiently throughout the enterprise.

Regardless of an executive’s specific role, the ability to bring in revenue remains a key factor in any strategic decision-making. Forrester research shows that three-fifths of B2B marketers find that shoppers spend more when interacting with multiple channels. Furthermore, omnichannel consumers are more likely to become long-term customers. All these findings indicate that enabling omnichannel engagement is essential for protecting and growing revenue in years to come.

The Mobile Effect

Smartphones are quickly surpassing computers as the primary source of e-commerce traffic. In fact, by the end of 2017, mobile devices are expected to account for 60% of internet traffic. This means that retailers must embrace mobile optimisation, including flawless mobile payment systems.

While this trend provides businesses with tremendous opportunities, it also introduces obstacles. Difficulty finding information, lengthy checkout times, and unwieldy procedures can each dissuade customers from completing their transactions. In a study commissioned by Genesys, researchers found that more than half of retail customers abandon online purchases if they encounter these problems. That means an organisation that puts the right information at customers’ fingertips will have the edge in attracting and retaining customers.

Embracing Self-Service

Once considered primarily a cost-saving measure, self-service technology has become a customer preference. A recent survey by Nuance Enterprise and published by Zendesk found these surprising statistics:

* 75% of customer respondents said that self-service technology is a convenient way to address customer issues.

* 67% said they preferred self-service over speaking to a company representative.

* 91% said they would use an online knowledge base if it was tailored to their needs.

The fact is, customers are ready to embrace self-service and wish to do so in the digitally-enabled, omnichannel environment. The catch is that the systems in place must be seamless and inviting to meet the needs of more sophisticated customers.

Channel Switching

While some executives fret over bygone days of in-person engagement, others embrace developing online trends. This includes the fact that 67% of retail customers start shopping on one device and finish on another – or even complete their purchase in a physical store. The same research shows that across all channels, shoppers use around 10 sources of information to make a purchasing decision.

The ability to use digital technology at home, on the go, or in-store – to research products, compare brands, read reviews, check product availability, and pay for items – enables the seamless experience many shoppers now demand to complete their purchases.

The new requirement is for companies – including retailers, banks, and others -- to provide for horizontal and even diagonal communications by integrating emerging technologies such as smartwatches and other mobile payment methods.

Case Study - Bank of America

Facing significant commoditisation, banks must gain a competitive advantage by delivering a superior customer experience. Bank of America has led the way, enabling self-service technology for tasks such as bill pay, mobile check deposit, and appointment scheduling through the company’s mobile and desktop apps. Additionally, it became clear that more traditional customers could be persuaded to move to digital channels.

To accommodate these customers, the company took an unusual approach to drive customers from the local branch to its ATMs. In 2013, Bank of America deployed its Teller Assist® program in four major cities. This program allowed customers to chat with a live person at the ATM, using videoconferencing technology.

In addition to providing the human interaction some customers prefer, these Teller Assist ATMs also extended traditional banking hours for customers who would normally visit the branch, but who need access outside regular banking hours.

While customers can’t apply for loans or carry out other more complex banking needs using digital channels, the company’s commitment to the omnichannel experience ensures maximum convenience for customers regardless of the channels they use.

“We’re seeing a change in customer behaviour because of technology… transactions and services are moving to other channels. But customers still want to acquire products at the branch. In many cases, these are products that need experts to sell them like investment advisors or mortgage brokers.” - Tyler Johnson, former Vice President of e-Commerce at Bank of America.

In conclusion...

In its 2015 Global Consumer Executive Top of Mind Survey, KPMG revealed that 62% of consumer market executives said that omnichannel strategy and technology will be either “very” or “critically” important to their company's success over the next two years.

“Omni-channel needs to be viewed in the context of merchandising. Leading retailers are analysing customer responses to different mixes of promotion, pricing and ranges — turning the dials to test and tweak options to better understand the optimal value proposition. Those businesses that have been slower to offer a greater mix of shopping channels or options are missing out on realising the commercial value of these benefits.

As a demand for omnichannel engagement grows, new technologies emerge that make more sophisticated interactions possible. The growing presence of mobile devices and networks creates greater opportunities to erase the lines between in-person and digital interactions. Retailers, financial institutions and other businesses will need to adapt in order to stay profitable and satisfy customers over the long term.

Know how to engage your target audience on different channels by enrolling in a globally recognised certificate course today - taught by the industry experts, to give yourself the best start possible.

Source: Digital Marketing Institute